Greece’s property market continues attracting international investors seeking both capital growth and European residency. With sustained price appreciation, favorable government policies, and one of Europe’s most accessible Golden Visa programs, the Greek real estate sector offers compelling opportunities for wealth preservation and lifestyle enhancement.

Current Market Performance and Regional Dynamics

The Greek property market delivered robust results in 2024, with national prices rising 8.7%—nearly double the inflation rate of 4.4%. This growth momentum stems from constrained supply, resilient demand, and Greece’s stable economic expansion of 2-2.3%.

Regional price performance varies significantly across the country:

| Region | Annual Growth | Average Price (€/m²) | Key Drivers |

| All Greece | 8.7% | €2,622 | Sustained demand, limited supply |

| Athens Centre | 11.8% | €2,524 | Urban regeneration, tourism |

| Athens South | 8.1% | €4,052 | Premium lifestyle districts |

| Crete | 14.1% | €2,425 | Resort demand, international buyers |

| Thessaloniki | 6.5% | €2,258 | Economic hub, student population |

| Corfu | 12.1% | €2,693 | Limited supply, European demand |

Athens remains the dominant investment destination, with southern districts commanding €4,052 per square meter. Transaction activity accelerated 15.8% to nearly 28,700 contracts, while new-build properties outperformed resales with 10.1% versus 7.8% price growth respectively.

Rental Market Yields and Income Potential

Greek rental markets offer attractive yields compared to other European capitals. National averages reach 4.5-5.6%, with exceptional opportunities in specific segments.

Key rental yield highlights:

- Small Athens apartments (under 75 sq.m): Up to 8.25% yield.

- Central Athens: 5.6% average yield.

- Thessaloniki: 5.2% yield.

- National average: 4.6% yield with 5-6% annual rental growth.

Long-term rentals particularly benefit from sustained demand. Central Athens occupancy rates hit 94% for new builds, while emerging markets like Mytilene and Ikaria attract digital nomads and remote workers, boosting regional yields.

Golden Visa Impact and Investment Pathways

The Greek Golden Visa program significantly influences property demand, accounting for approximately 10% of all transactions. In 2024, applications reached a record 9,407—an 11% annual increase.

Current investment thresholds (effective September 2024):

- €800,000: Properties ≥120 sq.m in prime areas (Athens, Thessaloniki, major islands).

- €400,000: Properties ≥120 sq.m in secondary regions.

- €250,000: Converted commercial properties or historic renovations (all regions).

Foreign real estate investment totaled €2.75B in 2024, with non-resident purchases expanding 29% annually. International buyers acquired approximately 17,900 properties worth €4.4B, demonstrating sustained global interest.

Golden Visa advantages include:

- Family inclusion (spouse, children to 21, parents).

- EU healthcare and education access.

- Visa-free travel across 29 Schengen states.

- No minimum residence requirements.

- Attractive tax regime (€100,000 flat tax on global income).

- Path to permanent residency (5 years) and citizenship (7 years).

Prime Investment Locations

- Athens: Leads in transaction volume and international appeal. Central districts average €2,254/sq.m, rising to €3,895/sq.m in prestigious southern suburbs. The capital benefits from world-class infrastructure, expanding tourism, and active development pipelines.

- Thessaloniki: Greece’s economic northern hub shows strong momentum with 6.5% annual growth and €2,452/sq.m average values. Entry-level opportunities start from €1,200/sq.m in select districts.

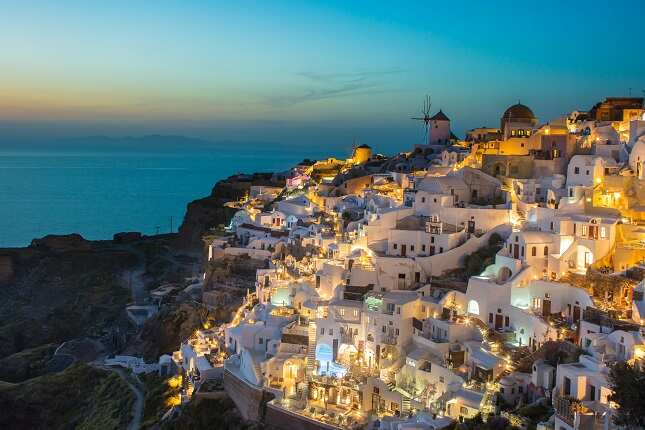

- Island Markets: Command premium pricing. Santorini averages €7,500/sq.m, while ultra-exclusive destinations like Kynthos and Antiparos reach €9,000-9,800/sq.m. These markets suit investors targeting luxury segments and maximum appreciation potential.

- Crete: Demonstrated exceptional 14.1% growth, driven by resort demand and international buyer interest, with values ranging €1,625-2,425/sq.m.

Market Forecast and Tax Considerations

Analysts project moderate growth deceleration for 2025-2026, with national price increases slowing to 3.7-3.2%. However, Athens, Thessaloniki, and tourist destinations may sustain 6-7% annual growth.

Tax incentives supporting investment:

- New builds purchased before end-2025: Only 3.09% transfer tax (24% VAT waived).

- Capital gains tax suspended until December 31, 2026.

- Attractive Non-Dom tax framework for residents.

Premium coastal properties and central Athens residences should maintain strong performance due to supply constraints and sustained foreign demand. Ultra-prime segments may achieve 5-7% growth even as overall market moderates.

Investment Strategy Considerations

Greece’s property market offers compelling fundamentals: economic stability, tourism growth, favorable demographics, and government support through residency programs. The combination of capital appreciation potential, rental yields, and European residency access creates unique value propositions for international investors.

Market dynamics favor selective investment in established locations with proven demand drivers. Professional guidance from immigration investment experts ensures optimal property selection, yield optimization, and regulatory compliance throughout the acquisition and residency processes.

For investors seeking European exposure with growth potential and lifestyle benefits, Greek real estate presents strategic opportunities aligned with global mobility trends and wealth preservation objectives.